Table of Content

At an average of $1,149 a year, we’re 69 percent cheaper than Allstate and 6 percent cheaper than Travelers. Homeowners searching for California homeowners insurance should make sure their policy can stand up to elements. MoneyGeek analyzed home insurance rates from 13 insurance companies in Oakland.

It also provides commercial insurance options to help businesses protect their properties and employees from a variety of liabilities. Pleasant Insurance Agency is an active member of the community and provided immediate support and assistance to clients in the wake of the Oakland Hills firestorm in 1991. Although most of the factors that determine discounts cannot be controlled by homeowners, they can benefit most by choosing deductibles to reduce home insurance rates. Homeowners can avail of attractive discounts by opting for higher deductibles. Oakland homeowners paying a high deductible of $2,500 can avail of a discount of $478.55 on homeowners insurance. Homeowners receive discounts of $400.83 and $269.14, respectively, on deductibles of $2,000 and $1,500.

David W Hansford LUTCF - Nationwide Insurance

Its team has more than 125 years of combined insurance experience. The customer satisfaction score of an insurance company is calculated using policy coverage, insurance rates, discounts, customer handling, and the speed at which a claim is processed. Power Score to choose insurance companies that ensure the satisfaction of policyholders. Homeowners who switch to Allstate mayreceive a discount up to a 10 percent. The insurer also may extend a potential discount for homes equipped with protective devices and when you purchase new coverage at least seven days before your current policy expires.

We apologize for the inconvenienceThe people search feature on Superpages.com is temporarily unavailable. You can still search for people on yellowpages.com since Yellow Pages and Superpages are part of one company. The median age of homes in California is 45 years old, according to an analysis of U.S. census data by House Method. And like everything else, the age of your home plays a role in how much you pay for home insurance in California. At Policygenius, our educational guides are written and fact-checked by licensed home insurance experts and reviewed by our Financial Review Council to ensure autonomy, expertise, and accuracy.

All "home insurance" results in Oakland, CA

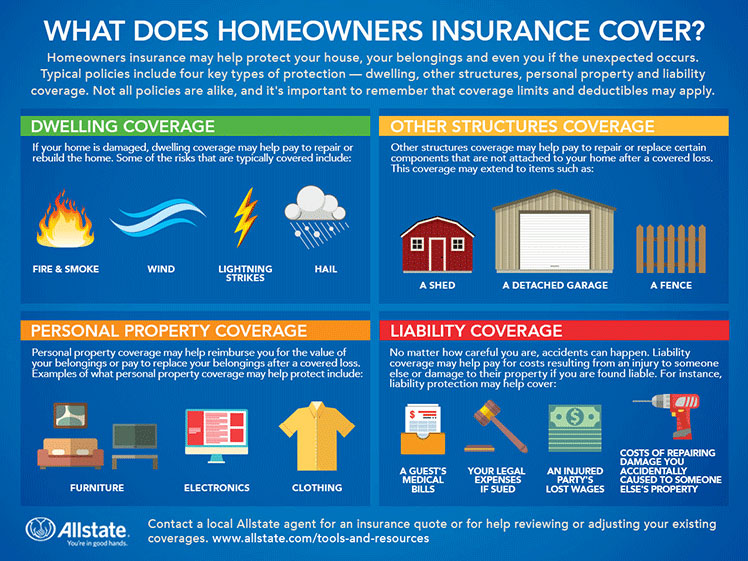

Rightworks Insurance Services helps secure the investments of individuals and businesses throughout the Oakland metro. The independent insurance agency offers homeowners' insurance packages. Its professional agents assist in finding a carrier that matches its clients' unique requirements. The company's policy plan includes coverage for damage repairs, loss of valuables, medical expenses for anyone injured on the property, and living expenses if temporary housing is required. Rightworks Insurance Services focuses on educating the communities surrounding it while utilizing a one-on-one service approach. Barbary Insurance Brokerage is an independent insurance agency that serves Oakland and the nearby areas.

One benefit of choosing Allstate is its extensive discount options. Homeowners can save up to 25% on their yearly premiums just by bundling their home and auto policies with Allstate. When talking about life insurance rates in Oakland, gender can make a big difference.

Best cheap homeowners insurance in San Francisco

Pat Howard is a managing editor and licensed home insurance expert at Policygenius, where he specializes in homeowners insurance. Rates were calculated using quotes for a 25-year-old male non-smoker in Oakland who is 5 feet 10 inches tall, weighs 152 pounds and has a 20-year term contract with a $360,000 coverage requirement. A 20-year term was chosen to provide a longer duration of coverage for a younger buyer.

All Kin policies include wildfire insurance to make sure your home is prepared for the worst-case scenario. This covers fire, smoke, and explosion damage to your home, belongings, and other structures. Based on the premiums , coverage and ease of customer access , I would recommend GEICO. I recommend State Farm for home insurance because the rates are affordable and they are quick to approve claims. There is never a hassle with them and they are friendly and professional. I am happy with the premium and the communication I receive regarding coverage and premium.

Negative Influences on Oakland Home Insurance Rates

Most insurance experts recommend shopping around to compare quotes, available discounts, available coverages and customer satisfaction ratings in order to find the best home insurance company for you. Your homeowners insurance premiums will vary depending on both your company and how much dwelling coverage you need to protect your home from serious weather damage. Your dwelling coverage limit should be equal to your home’s replacement cost — not its market value.

We continually strive to provide consumers with the expert advice and tools needed to succeed throughout life’s financial journey. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy. Your actual rates will be determined by the size and value of your home, the number of people living in it, whether you own a dangerous breed of dog, and several other factors. They understand your risks and will find you the coverage you need.

The agency provides homeowners insurance, as well as personal and commercial insurance, from a variety of insurers, including Liberty Mutual, Mercury, and Progressive, among others. Its home insurance products include homeowners, renters, condo, in-home business, mobile home, and landlords insurance. Del-Rose Insurance Services offers solutions to individuals in Oakland and its surrounding areas. Its team also offers clients car insurance, applicable to various makes and models of standard autos, and to other motor vehicle types like trucks, boats, sports bikes, jet skis, and vans.

Your home insurance policy can provide you with coverage against many of the hazards you are likely to face as a homeowner. That way, covered loss or damage to your home will not cause you to suffer undue financial losses. With the high burglary rate in this city, residents are advised to keep doors and windows securely locked, and entryways to their homes well-lit. If you are the victim of a burglary, your homeowners insurance can provide you with compensation for your losses.

In addition to looking at how much each insurance company charges for different coverage levels and risks, you should also be aware of what your policy does and doesn’t cover. When youbuy homeowners insurancein California, there are three additional coverage options you may need to consider to protect against the state’s frequent natural disasters. For a $250K in life insurance coverage in Oakland, Transamerica offers the cheapest rate for both men and women.

Homeowners who value digital policy management may find what they’re looking for with Travelers’ highly-rated mobile app. In addition to a relatively low average premium, policyholders may save even more with potential discounts for buying a new home, remaining claims-free and having a LEED-certified home. The company also offers a variety of add-ons for policy customization including green home coverage.

No comments:

Post a Comment